Since mid of August, I have started doing this as a study so the readers of this blog can learn along with me. I am also giving valuable list of stocks for quick profit. If anyone bought Kiriindus and Trent on the morning of 25th August as they showed up in 24th August list, they would have gotten a profit of 4-6% by evening.

I got inspired for this selection when I once noticed Indigo on daily chart and next day bought its CE at 9 and sold at 18 after few hours. Later traded TNPL, INFIBEAM, DIAMONDYD, JOCIL, BLISSGVS, ATULAUTO, during mid weeks of August and booked about 5% profit in a short time. Every stock may not rise the very next day. But I observed the potential for a rise in the next 10 days, on few stocks over a historical period of five years. Thus I decided to make such list everyday and trade familiar stocks or observe them for building trading watchlists to grow familiarity to trade later.

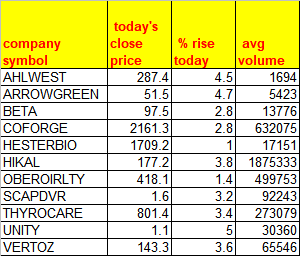

Today's short term selection list for short term study (2 weeks timeframe). Their performance will be reviewed after 6-Oct along with two weeks lists at one time.

Today's list got '0' stocks.

However 11 stocks showed up in the secondary list.

company symbol today's close price % rise today avg volume

AHLWEST 287.4 4.5 1694

ARROWGREEN 51.5 4.7 5423

BETA 97.5 2.8 13776

COFORGE 2161.3 2.8 632075

HESTERBIO 1709.2 1 17151

HIKAL 177.2 3.8 1875333

OBEROIRLTY 418.1 1.4 499753

SCAPDVR 1.6 3.2 92243

THYROCARE 801.4 3.4 273079

UNITY 1.1 5 30360

VERTOZ 143.3 3.6 65546

Same table as a picture.

Commentary:

Retracements and pauses are common in downtrend. That is how one will miss exiting hoping for more rise. However this time, our markets will not fall all the way to March lows because the stimulus that was announced at that time would go waste. Markets are falling for expected delay in next stimulus announcement in US. At the most these could fall to 50% point between March lows and recent peak levels since March till now.

That means 9500 is the retracement level for NIFTY. Nifty could fall more than US markets because of the recent stake sale hungama going on in our markets. Govt. started selling HAL shares. Esselpack promoter did major sale last week. Today and tomorrow GMMPFAUDLER promoters are doing offer for sale, which is simply stake in a little different way than dumping in the open market.

Govt. lost taxes by way of lockdown extensions that shut down the economy. So no earnings. No taxes to govt. The recent sharp and relentless rise in the market is seen by companies to book the too-good-to-be-true profits, in the face of increasing covid cases. Hence it is not a good idea to buy any stocks at high levels. Buy on pullbacks. That too only good stocks for long term. For short term, better to wait till sentiment changes "decisively" to positive. Till then observe which sectors are getting investor interest and relate to the news and potential future.

If you liked this post, please check any of the Reaction boxes below and subscribe to this blog or follow by adding email on the right side of the blog. If you want to post any questions or share thoughts, feel free to add comments below.

Read the disclaimer on the right side of this blog (in desktop mode) before making any investment/trading decisions.

No comments:

Post a Comment