Since mid of August, I have started doing this as a study so the readers of this blog can learn along with me. I am also giving valuable list of stocks for quick profit. If anyone bought Kiriindus and Trent on the morning of 25th August as they showed up in 24th August list, they would have gotten a profit of 4-6% by evening.

I got inspired for this selection when I once noticed Indigo on daily chart and next day bought its CE at 9 and sold at 18 after few hours. Later traded TNPL, INFIBEAM, DIAMONDYD, JOCIL, BLISSGVS, ATULAUTO, during mid weeks of August and booked about 5% profit in a short time. Every stock may not rise the very next day. But I observed the potential for a rise in the next 10 days, on few stocks over a historical period of five years. Thus I decided to make such list everyday and trade familiar stocks or observe them for building trading watchlists to grow familiarity to trade later.

Today's short term selection list for short term study (2 weeks timeframe). Their performance will be reviewed after 14-Oct along with two weeks lists at one time.

Today's primary list has only 9 stocks showing up.

company symbol today's close price % rise today avg volume

ALPA 30.6 5 155728

DTIL 259.6 4.6 22590

GRSE 216.3 13.1 396864

JAYBARMARU 226.6 2 63662

LINCPEN 179.8 3.1 9074

MAHICKRA 80 5.4 10770

SPAL 134.3 20 106448

TWL 47.5 7.7 484453

VIMTALABS 118.9 5 293672

Same table as a picture.

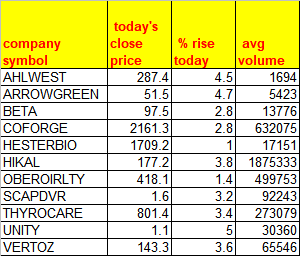

In the secondary list we got 39 stocks.

company symbol today's close price % rise today avg volume

AARTIDRUGS 771.3 -73.8 1762439

ALPA 30.6 5 155728

ASTRAL 1224.8 6 179142

BEDMUTHA 18.4 2.2 11231

BHAGYANGR 18.5 2.8 11398

CGCL 235.7 5.6 153882

CGPOWER 23.9 4.4 9226036

CHAMBLFERT 157.8 1.8 1207863

CROMPTON 292.4 4.8 856650

DTIL 259.6 4.6 22590

DYNPRO 261.7 7 308753

ELGIEQUIP 121.3 1.9 256349

ENDURANCE 1152.3 3.9 94117

FMGOETZE 426.8 7.7 10461

GFLLIMITED 95.5 3.1 50470

GODREJCP 725 2.8 1327131

GRSE 216.3 13.1 396864

GSS 32.9 7.7 375107

HIMATSEIDE 91.5 7.5 704616

JAYBARMARU 226.6 2 63662

JHS 22.6 4.9 112520

KEC 344.5 1.5 498791

KRBL 289.9 1.5 369362

LINCPEN 179.8 3.1 9074

MAHICKRA 80 5.4 10770

MPHASIS 1383.5 5 569106

NAVINFLUOR 2202.3 5.3 143896

NH 358 3.4 236971

OPTIEMUS 56.4 4.9 54920

SALASAR 198.9 4.1 39424

SHALBY 87.7 2.5 278518

SOLARA 1076.1 6.4 232612

SPAL 134.3 20 106448

SUMMITSEC 406.4 2.1 3027

TITAN 1201.3 2.9 3405776

TWL 47.5 7.7 484453

UNITY 1.1 4.8 29448

URJA 3.2 4.9 1866621

VIMTALABS 118.9 5 293672

Same table as a picture.

Commentary:

Today TIPSINDLTD had a good fall of 8%. Kept it in my watch list. As there is no event or news affecting the markets it is simply going up and down indecisively. After a couple of weeks a direction comes out.

Today's list got some stocks like LINCPEN. It is a small cap I once tried for BTST trading. Buy today and sell tomorrow. It didn't work actually. Later I averaged it and got out with profits after noticing its price pattern on charts. It behaves like a good small cap stock that steadily tries to break out two times and breaks out third time with big % gain in a single day. Then I get out. However it is not good in the long run.

Many stocks are falling from one range to another range, always lower than the previous range as time passed since the last two years. Our govt. doesn't encourage long term investing. Even earlier govt. too ruined the reputation with Vodafone tax case for more than a decade. With LTCG tax, no encouragement from budgets, GST saga, demonetization event, businesses are simply struggling to conduct their own business.

Hence for long term investing one has to pick only growth stocks or value stocks and preferably on pullbacks or do SIP. The companies that can bounce back due to lack of debt on balance sheets are also good for long term SIP. Given long enough time some good news will come, provided company doesn't goof up on its own in that time period. Debt is like a ticking time bomb that ruins even the best managed businesses.

For BTST trading, the hit rates are not so good. But when following ORB strategy few months ago, i felt sometimes BTST is possible. I will study data if some pattern can be found for BTST trading setups.

As market becomes stable, day after day more and more stocks will start showing up. Usually the laggers show up late. Those should be taken as exit opportunities.

Over time I am beginning to realize that the only short term trading worth from this is the jackpot type. Like that to be done in TIPSINDLTD. Timeframe should not be fixed. But one need to take chances for such moves. We need to see some fundamentals, check for fraud or rumors of such thing, any recent news, future expectation and quarterly result trend. Keeping these in mind, we can take chances. Even if we our success ratio is 33%, we could still make good gain as one gaining trade offsets the losses of two. For that the 2 week timeframe is perfect exit point. Because once we are in, a momentum stock will not stop for that much time and keeps rising.

If you liked this post, please check any of the Reaction boxes below and subscribe to this blog or follow by adding email on the right side of the blog. If you want to post any questions or share thoughts, feel free to add comments below.

Read the disclaimer on the right side of this blog (in desktop mode) before making any investment/trading decisions.

Continue reading...