Some day trading basics for dummies :).

Wikipedia defines day trading accurately. "Day trading refers to the practice of buying and selling financial instruments within the same trading day such that all positions are usually closed before the market close for the trading day.

Day trading used to be the preserve of financial firms and professional investors and speculators. Many day traders are bank or investment firm employees working as specialists in equity investment and fund management. However, with the advent of electronic trading and margin trading, day trading has become increasingly popular among casual, at-home traders".

It is important to note the time boundaries of day trading. Morning till evening. That's it. Many traders however are not true day traders as they choose to hold onto the position if the stock price movement is stronger than what would be for a candidate of day trading. Such stock bets are generally found by looking up long term bets and not short term.

Wikipedia defines day trading accurately. "Day trading refers to the practice of buying and selling financial instruments within the same trading day such that all positions are usually closed before the market close for the trading day.

Day trading used to be the preserve of financial firms and professional investors and speculators. Many day traders are bank or investment firm employees working as specialists in equity investment and fund management. However, with the advent of electronic trading and margin trading, day trading has become increasingly popular among casual, at-home traders".

It is important to note the time boundaries of day trading. Morning till evening. That's it. Many traders however are not true day traders as they choose to hold onto the position if the stock price movement is stronger than what would be for a candidate of day trading. Such stock bets are generally found by looking up long term bets and not short term.

In my opinion it is not a good idea to trade strictly in a day. We need to be flexible. Already there are are lot of contraints for a short term trader from the markets, stocks and the brokers, and adding the time constraint above it can result in lost opportunies if not making things worse.

If you are afraid of Day trading it is not because it is risky but because you don't have the courage to assume the loss first before beginning the trade.

Making Sense of Day Trading: If you are new to day trading, there are many topics and terms to become familiar with. Day trading is investing in the stock market, but trading with a short term profit strategy, often involving multiple transactions throughout a single day.

If you are afraid of Day trading it is not because it is risky but because you don't have the courage to assume the loss first before beginning the trade.

Making Sense of Day Trading: If you are new to day trading, there are many topics and terms to become familiar with. Day trading is investing in the stock market, but trading with a short term profit strategy, often involving multiple transactions throughout a single day.

In the past, day trading was only an option for professional investors, professional traders (speculators) and financial corporations that had the resources and technology available. With the invention and expansion of the internet, day trading is a strategy available to almost any investor with a brokerage account and access to the internet.

Some day traders trade on a short term basis while others have a longer term strategy. Short term traders may only hold onto a security for seconds, minutes or a portion of a day. Long term traders may hold a position for a day or even a couple of days to attempt to turn a profit.

Day traders also have several styles of trading. Trend traders are when day traders sell or buy when a security goes up or down in value. Counter traders occur when a trader goes back and forth within two prices on the same security.

Some day traders choose a single style, while others use styles in combination to get the best results.

Day traders can trade within the securities markets, commodities markets, options markets and futures markets. Almost any underlying security can be leveraged in a day trading strategy.

If you are considering leveraging this strategy, consider evaluating the many tools that are offered to traders including independent software and the assistance that your brokerage firm may provide.

In India, Power Indiabulls trading software seems to be the best one with lot of features to match the likes provided by brokers in US. But beginners don't need that.

Some day traders trade on a short term basis while others have a longer term strategy. Short term traders may only hold onto a security for seconds, minutes or a portion of a day. Long term traders may hold a position for a day or even a couple of days to attempt to turn a profit.

Day traders also have several styles of trading. Trend traders are when day traders sell or buy when a security goes up or down in value. Counter traders occur when a trader goes back and forth within two prices on the same security.

Some day traders choose a single style, while others use styles in combination to get the best results.

Day traders can trade within the securities markets, commodities markets, options markets and futures markets. Almost any underlying security can be leveraged in a day trading strategy.

If you are considering leveraging this strategy, consider evaluating the many tools that are offered to traders including independent software and the assistance that your brokerage firm may provide.

In India, Power Indiabulls trading software seems to be the best one with lot of features to match the likes provided by brokers in US. But beginners don't need that.

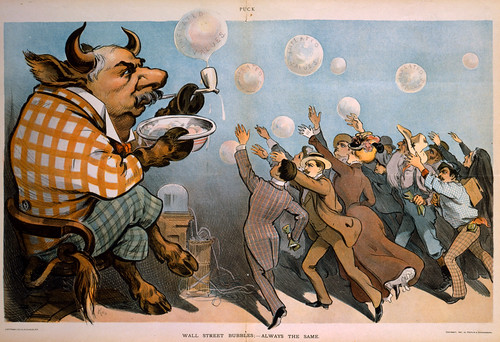

Day Trading is Highly Profitable When Bubbles Burst

Like the sudden market crash due to derivatives margin failure on January 21 2008 or the bear squeeze by the frantic bull run after UPA won elections in India on May 18 2009. But the risky will be very high at that time. Strictly speaking the second case (may 18) is actually not useful for day trader as the market gapped up and no trading happened on the way. Only speculators or gamblers dare to play with such large gaps.

1 comment:

Day trading for beginners is like lion taming, except more expensive. It's a risky and challenging pursuit: buying stocks and selling them again in the same day, making money off tiny fluctuations in the price of a stock over a twelve hour period. For many years the tools of day trading were not available to the average investor: real time stock results, analysis tools and access to instant trades.

http://www.livetraders.net/

Post a Comment