Happy Teacher's day to this blog readers. On this day, I will do a study below so you as a student can learn something from this.

I am putting a table below which I will explain after that.

| company symbol | buy price | min price | max price | 10th day price | target met | % gain min. to 10th day | % gain buy day to max. | % gain buy day to 10th day |

| ADVANIHOTR | 46.85 | 43.8 | 47.25 | 44.75 | 0 | 2.2 | 0.9 | -4.5 |

| ARCHIES | 12.65 | 12.1 | 13.05 | 12.55 | 0 | 3.7 | 3.2 | -0.8 |

| CARBORUNIV | 267.05 | 259.45 | 282 | 261.3 | 1 | 0.7 | 5.6 | -2.2 |

| CENTENKA | 192.3 | 168.6 | 192.3 | 170.4 | 0 | 1.1 | 0 | -11.4 |

| CESC | 633.75 | 600.45 | 648.95 | 610.35 | 0 | 1.6 | 2.4 | -3.7 |

| EIHAHOTELS | 276 | 250.8 | 276.1 | 250.8 | 0 | 0 | 0 | -9.1 |

| EXCELINDUS | 843.15 | 832.6 | 921.8 | 854.55 | 1 | 2.6 | 9.3 | 1.4 |

| GATI | 48.8 | 45.1 | 49.3 | 46 | 0 | 2 | 1 | -5.7 |

| GIPCL | 80.25 | 73.1 | 80.25 | 73.85 | 0 | 1 | 0 | -8 |

| INDRAMEDCO | 59.15 | 49.7 | 59.85 | 50.1 | 0 | 0.8 | 1.2 | -15.3 |

| ITDC | 255.1 | 236.7 | 262.55 | 243.3 | 0 | 2.8 | 2.9 | -4.6 |

| NIITLTD | 108.5 | 108.5 | 136.25 | 127.75 | 1 | 17.7 | 25.6 | 17.7 |

| ORIENTCEM | 71.5 | 64.9 | 71.5 | 64.95 | 0 | 0.1 | 0 | -9.2 |

| ORIENTELEC | 185.85 | 185.85 | 207.95 | 199.9 | 1 | 7.6 | 11.9 | 7.6 |

| POWERGRID-1M | 181.75 | 175.85 | 189.55 | 179.3 | 0 | 2 | 4.3 | -1.3 |

| PRECOT | 26.05 | 26.05 | 29 | 29 | 1 | 11.3 | 11.3 | 11.3 |

| SCHNEIDER | 83.8 | 80.3 | 87.35 | 85.45 | 0 | 6.4 | 4.2 | 2 |

| SIRCA | 236.45 | 236.45 | 273.4 | 270.85 | 1 | 14.5 | 15.6 | 14.5 |

| TCNSBRANDS | 383.05 | 372.6 | 449.25 | 381.15 | 1 | 2.3 | 17.3 | -0.5 |

| TTKPRESTIG | 5656.35 | 5656.35 | 6145.3 | 6145.3 | 1 | 8.6 | 8.6 | 8.6 |

| UNITEDTEA | 311.9 | 307.35 | 329.3 | 320.7 | 1 | 4.3 | 5.6 | 2.8 |

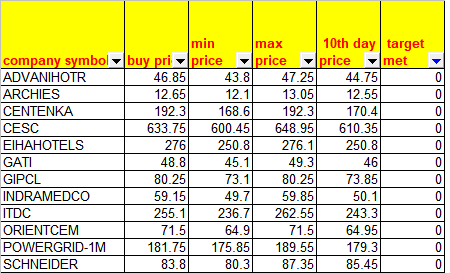

Same table as a picture.

Looks like it doesn't fully fit into the width of the post. You can click on it to open in a new window in full size.

Analysis of Performance

The first two columns are straightforward to understand. I have listed symbols and the buy price as on the day of filtering (20th August), assuming you could buy it around same price on the next day morning. Starting from the day after that, that is 21st August, till 10 days we take the closing prices and put the minimum, maximum and 10th day prices in the next three columns. This is because our window of interest is 2 weeks timeframe (10 trading days), as mentioned in the title of each list when they are posted.

The next column, target met is a 1 if we could get a price 5% higher than the buy price within those 10 days, otherwise 0. That means if we were to consider only 5% as target gain and have limit order placed to sell the stock for the next 10 days, all the stocks which had 1 for this column, would have been sold with 5% gain. Others having 0 haven't met the target.

Now we consider various ways of managing these positions, assuming one would have bought all the stocks on the day zero (20th August). I am assuming this way to avoid adding a variable of uncertainty for another round of stock selection, which we can study and find out better ways in the future based on what we learn from these studies. These various scenarios are also to see which way we can maximize our gains. So let us study each scenario.

Scenario 1 - 5% target gain:

Let us say we buy at the price close to the day zero closing price and use limit orders to sell for 5% profit.

We have a total of 21 stocks and from that 9 stocks have risen to get sold at 5% profit. So we see '1' as value for column "target met". The above table shows the stocks that met the 5% target.

The above table lists the remaining 12 stocks that didn't meet the 5% target within the 10 days time. Now these need to be closed somehow. As we didn't assume a stop loss, we can consider these to be closed on the 10th day for whatever price we can get at the close of the 10th day.

The total of losses is -71.6%. Per stock loss is -6%. Don't worry about +/- symbols. I am always putting '-' when there is a loss so it is simple for the mind to note it.

From the gains in this scenario we can easily understand the per stock gain is 5%.

To arrive at total gain on capital: assuming you divided your capital equally and bought all the stocks with same capital. Adding gains of 5*9=45% and losses of -71.6%, we get total = -26.6%. Then divide by 21 (number of stocks), we get net loss of -1.3%.

That turned out to be a poor performance and it can fall flat on my face, after adding brokerages. Let us say we use Zerodha. It would easily be -1.5% net loss, considering exchange charges & taxes as Zerodha doesn't charge brokerage for delivery positions. Let us ignore the rare cases of buying on Day1 and selling for 5% target on the same day, for the purpose of simplification. We can study that another time. Let us go to scenario 2.

Scenario 2 - Sell all on 10th Day:

Let us say we buy at the price close to the day zero closing price and wait till 10th day. Then sell for whatever price we can get on that day's close.

For this we will look at the same table at the beginning of this post. If we sum up the gains of all stocks on the tenth day (last column), we get a total of -10.4%. Dividing by 21 we get net loss of -0.5% for the capital.

This also turned out to be poor. Again assuming Zerodha for charges, we have net loss of -0.71%. It is good to consider Zerodha for delivery positions. These are the minimum charges we can trade with.

I am guessing the main reason for the net gain to be negative is because of the sudden big fall in the market from last Monday (31-August) which was within the 10 day window. Because I did a quick check for this scenario on a list that we could have gotten on 28-July and found 17 stocks with total gain of 83.5% or net gain of 4.9% on capital. Below is the table for that. Click on it to see it clearly in a new window.

But then we know that the broader market went up after 28th July within the next 10 days. So it matters when we trade the stocks. Good that the losses are limited to less than 1%. Need to see how things go for lists on later days. For them, I won't explain in this much detail, but simply post the summary for each scenario. Now let us see two more not-so-realistic scenarios as the first two.

Scenario 3 - Sell at max. price within 10 days:

Let us say we buy at the price close to the day zero closing price and sell each stock at the max. price within 10 days. Let us just assume this is done, although unrealistic for the sake of seeing numbers.

For this, we can see the last but one column in the very first table. This leads to a total gain of 130.9% or net gain of 6.2%. So 6% after charges which is good!

Let us do same relative comparison for the 28-July list. That has a total of 142.4% and net gain of 8.4% or 8.2% after charges. So this means even this scenario gets better based on market phase. When there is bullishness it gets better.

Scenario 4 - Buy at min. price within 10 days and sell on the 10th day:

Let us say we buy each stock at its min. price within the 10 days and sell all stocks on the 10th day. This is also unrealistic as we may not get the min. price exactly and for each stock. But for the sake of study let us assume.

For this, we can see the last but second column in the very first table. This leads to a total gain of 93.3% or net gain of 4.4%.

Now you could wonder why not consider min. for buy and max. for sell. Let us not overreach ourselves into too much of unrealistic scenarios. My idea behind seeing these numbers is that if we don't see great results here certainly the first two scenarios too won't meet our target gain. If we get atleast 10% net gain from these last two scenarios we can consider that this is a good method to pick stocks for a 5% target gain.

For the sake of completeness, let us see what happened with 28-July list for this scenario. That shows 171.5% total gain or net gain of 10.1% on capital. So we can conclude that the market phase (bullish sentiment) is important. Or we can also try to limit the target gain.

Here we see 10% in the unrealistic scenario that lead to 5% gain in realistic scenario (scenario 2) for 28-July case. Now what happens for scenario 1, if we limit the target gain to 2.5%?

This leads to 13 stocks meeting target and 8 not meeting for a net loss of -1.64%. Same thing for 28-July shows a net loss of -0.35% for the capital. So reducing our target gain to 2.5% doesn't help at all.

I think this is because here the stocks that rise, tend to rise much more later on. So if we don't put target limits and simply sell on 10th day, the rising stocks can very well offset losses of falling ones. I am pulling this list based on their recent show of strength. So even if the market turns negative in the time period, the falling stocks might still bounce back given some time. This is why we are giving ten days instead of 1-3 days.

After studying this one list, you could be curious to know what happens for other days. During the bullish phase of June-July and the bearish phase that started from last Monday. Now that we have seen how these scenarios look for one data set, we can simply look at the net gain/loss numbers of all scenarios (or simply the realistic scenario 2) for all data sets over a period of time. That requires crunching numbers again. I will study that sometime and post the results.

But this also leaves us wondering how to further select the stocks from this list. Because in the two dates that I have presented here, (20-Aug and 28-Jul), about half the stocks did well and remaining didn't. Is it as good as tossing a coin or is there some pattern? Once performance review of more datasets is completed, there could be some pattern that could be detected.

Also another study to randomly pick about say 20 stocks on a given day from the total list of stocks on the exchange and studying their performance in scenario 2, on data sets over a time period could give us an idea if this stock selection is worth at all? My intuition is that this selection should have some positive bias compared to a random selection. But I can study that and post the results for that as well, which again requires more number crunching tasks.

We can also do one more thing. Post 10 days, the stocks that turn out to be good can be moved to long term watch list. Then after one quarter, filter again to keep only stocks that did well in that period. Or in relation to NIFTY or Reliance let us say, so as to not get everything out of the list if the whole market falls next quarter.

If you liked this post, you can check any of the Reaction boxes below. If you want to post any questions or share thoughts, feel free to add comments below.

If you have any ideas to further improve the gain from this list, I would like to hear it and do a study.

Read the disclaimer on the right side of this blog (in desktop mode) before making any investment/trading decisions.

No comments:

Post a Comment